Anne makes the distinction between technological complexity and social complexity. They’re not the same, though they depend on each other intimately. Technological complexity is related to what kind of machines we can build; social complexity is related to how our society functions. The rule of law, democracy, and corporations all fall under social technology.

When constraints change radically, society sheds complexity. The complexity that stays is not waste. We keep complexity that people find valuable. So that’s another distinction that matters to me: helpful complexity and wasteful complexity. Wasteful complexity, cruft, muda – if you can remove the waste before it becomes too great and drags you down, you can navigate your way to another stable state.

So what are examples of social complexity that are waste, muda? Here’s the start of my list:

I’m sure you have yours, and the list goes on. These are social systems that suck energy, but give back no or even negative value. Our taxes pay Blackwater, for instance, and all we’re getting out of that is social instability.

There is social complexity that adds value:

And this leads me to another problem that I call the “bitter anarchist problem.” In my mind it’s exemplified by Derrick Jensen, but could easily be applied to many “leftists” these days. The problem is this: many leftists and anarchists complain bitterly about the way society is today, but then do little or nothing to change society.

Business is powerful in the world today because businesses ship products and services. Shipping products organizes peoples’ thinking, lives, and work in a particular way – the people who ship them, buy them, and even the people who don’t buy them, but live in the society that coexists with them. What a company ships expresses its viewpoint on how life ought to be for people. Buying the products and services, you give energy to that company to make it more effective at creating the vision it is expressing.

In this way, businesses grow organically, using the wealth created from the products to feed new investment in innovation or expansion. Corporations use this methodology to create systems that siphon wealth from one group and hand it to another; we can use it to create wealth and distribute it equitably. We can argue whether this system has been helpful or wasteful, but it does exist, and we participate in it.

So if we want to have an effect on what kind of world we live in, and our children live in, I think we need to ship products and services and systems of living that embody the world we want. We don’t have to use the control structures of oppression to do it. The nature of information economies helps decentralized organizations, because digital information can be copied and distributed freely at low cost.

But we do have to ship. I haven’t seen many leftists or anarchists who do this. Perhaps that is because they have a different conception of work: work is something to avoid, to hate, to fight against. It’s factory work – dull, routine, dangerous. It kills the planet. You can see this in the labor-management struggles of the 1800s and 1900s.

But that’s not how all work has to be. Work is now dominated by information. Better ideas can radically transform a team, a business, a society. And to get better ideas, you need creativity. Creativity doesn’t thrive under oppression, it thrives under safety and freedom.

Teams and organizations that learn to use this to their advantage will have a lot of influence on our society. But people don’t yet know much about organizing effective work in the information age. Lean Manufacturing is one idea, and Eric Ries‘ Lean Startup movement is another, a lively green shoot growing up out of the Agile software development movement. I’d put Y Combinator and the Hacker News community close by.

For me, the answer isn’t clear yet. I want to combine the Core Protocols with Lean Startups to get fun, non-coercive, highly-effective, profitable companies with triple bottom lines – caring for people, planet, and profit. They would be similar to Bruce Sterling’s global civil societies, or maybe John Robb‘s resilient communities.

Why the Core Protocols? It’s the best actionable way I’ve found to create truly great teams. Built in to the Core is non-coercion and personal growth, so teams that adopt it are ready for shipping products and services for this information age.

But it’s also a way to reduce wasteful complexity. Over at Hacker News, and other places, people often wonder how to scale a company beyond the founding team. Why do many companies grow less effective as they grow bigger and older? How do you keep that energy and effectiveness alive? To grow, many companies put in place structures to keep order – processes and rules that can keep peoples’ effort moving in the same direction, but often stifle creativity and decision-making.

Another related question is, how can you stay small but still be radically effective? How can you create great products quickly, and ship them often, without having a huge team? Or another way to say this, how can you have wide effect, without having to incur a lot of muda, a lot of work that adds no value?

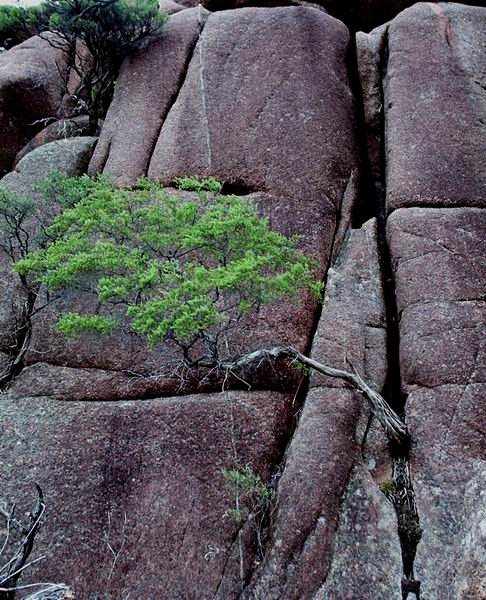

The way to do that from the viewpoint of the Core Protocols is to spend your team’s energy on getting to and staying in a state of shared vision. Want to live in a peaceful world, where people are happy, the water is clean, and the forests huge and un-cut? Ship it.